信頼できるアフターサービス

私たちのCIMAPRO15-P01-X1-ENG試験学習資料で試験準備は簡単ですが、使用中に問題が発生する可能性があります。CIMAPRO15-P01-X1-ENG pdf版問題集に関する問題がある場合は、私たちに電子メールを送って、私たちの助けを求めることができます。たあなたが新旧の顧客であっても、私たちはできるだけ早くお客様のお手伝いをさせて頂きます。候補者がP1 - Management Accounting Question Tutorial試験に合格する手助けをしている私たちのコミットメントは、当業界において大きな名声を獲得しています。一週24時間のサービスは弊社の態度を示しています。私たちは候補者の利益を考慮し、我々のCIMAPRO15-P01-X1-ENG有用テスト参考書はあなたのCIMAPRO15-P01-X1-ENG試験合格に最良の方法であることを保証します。

要するに、プロのCIMAPRO15-P01-X1-ENG試験認定はあなた自身を計る最も効率的な方法であり、企業は教育の背景だけでなく、あなたの職業スキルによって従業員を採用することを指摘すると思います。世界中の技術革新によって、あなたをより強くする重要な方法はP1 - Management Accounting Question Tutorial試験認定を受けることです。だから、私たちの信頼できる高品質のCIMA Certification有効練習問題集を選ぶと、CIMAPRO15-P01-X1-ENG試験に合格し、より明るい未来を受け入れるのを助けます。

本当質問と回答の練習モード

現代技術のおかげで、オンラインで学ぶことで人々はより広い範囲の知識(CIMAPRO15-P01-X1-ENG有効な練習問題集)を知られるように、人々は電子機器の利便性に慣れてきました。このため、私たちはあなたの記憶能力を効果的かつ適切に高めるという目標をどのように達成するかに焦点を当てます。したがって、CIMA Certification CIMAPRO15-P01-X1-ENG練習問題と答えが最も効果的です。あなたはこのP1 - Management Accounting Question Tutorial有用な試験参考書でコア知識を覚えていて、練習中にP1 - Management Accounting Question Tutorial試験の内容も熟知されます。これは時間を節約し、効率的です。

現代IT業界の急速な発展、より多くの労働者、卒業生やIT専攻の他の人々は、昇進や高給などのチャンスを増やすために、プロのCIMAPRO15-P01-X1-ENG試験認定を受ける必要があります。 試験に合格させる高品質のP1 - Management Accounting Question Tutorial試験模擬pdf版があなたにとって最良の選択です。私たちのP1 - Management Accounting Question Tutorialテストトピック試験では、あなたは簡単にCIMAPRO15-P01-X1-ENG試験に合格し、私たちのP1 - Management Accounting Question Tutorial試験資料から多くのメリットを享受します。

CIMAPRO15-P01-X1-ENG試験学習資料の三つバージョンの便利性

私たちの候補者はほとんどがオフィスワーカーです。あなたはP1 - Management Accounting Question Tutorial試験の準備にあまり時間がかからないことを理解しています。したがって、異なるバージョンのCIMAPRO15-P01-X1-ENG試験トピック問題をあなたに提供します。読んで簡単に印刷するには、PDFバージョンを選択して、メモを取るのは簡単です。 もしあなたがP1 - Management Accounting Question Tutorialの真のテスト環境に慣れるには、ソフト(PCテストエンジン)バージョンが最適です。そして最後のバージョン、CIMAPRO15-P01-X1-ENGテストオンラインエンジンはどの電子機器でも使用でき、ほとんどの機能はソフトバージョンと同じです。P1 - Management Accounting Question Tutorial試験勉強練習の3つのバージョンの柔軟性と機動性により、いつでもどこでも候補者が学習できます。私たちの候補者にとって選択は自由でそれは時間のロースを減少します。

CIMA P1 - Management Accounting Question Tutorial 認定 CIMAPRO15-P01-X1-ENG 試験問題:

1.

Calculate the sensitivity of the investment decision to a change in the annual fixed costs.

By how much should the present value of the fixed cost increase, before this project is not viable?

A) $7698

B) $8675

C) $6390

D) $9050

2. XY, a not-for-profit charity organization which is funded by public donations, is concerned that it is not making the best use of its available funds. It has carried out a review of its budgeting system and is considering

replacing the current system with a zero-based budgeting system.

Select ALL the potential advantages AND disadvantages for the charity of a zero-based budgeting system.

A) The creation of decision packages and their subsequent ranking by top management is very time consuming and costly. The charity will need to assess whether the benefits of the system outweigh the costs involved.

B) In applying traditional budgeting, 'activities' may result in functional departments rather than cross functional activities and thus distract attention from the real cost-reduction issues.

C) Preparation of the decision packages will normally require the environment of many employees. This environment may produce useful ideas and promote job satisfaction.

D) It avoids the complacency inherent in the traditional incremental approach where it is assumed that future activities will be very similar to current ones.

E) It discourages a questioning approach by focusing attention not only on the cost of the activity but on the benefits it provides. The charity managers will not articulate the benefits encouraging them to think clearly about the activities.

F) In an organization like a charity, the decision packages are not very disparate and difficult t compare.

3. Explain the advantages of management participation in budget setting and the potential problems that may arise in the use of the resulting budget as a control mechanism.

Select all the correct answers.

A) Participation in budget setting can cause problems; in particular, managers may attempt to negotiate budgets that they feel are easy to achieve which gives rise to "budget padding" or budgetary slack.

B) Another purpose of a budget is to set targets to motivate managers and optimize their performance.

C) A purposes of budgeting is to act as a control mechanism, with actual results being compared against budget.

D) The participation of managers in the budget setting process has several advantages. Managers are more likely to be motivated to achieve the target if they have participated in setting process has several advantages. managers are more likely to be motivated to achieve the target if they have participated in setting the target.

E) Managers will not 'empire build' because they don't believe that the size of their budget reflects their importance within the organization.

F) Participation in budget setting can reduce the information asymmetry gap that can arise when targets are imposed by senior management. Imposed targets are likely to make managers feel demotivated and alienated and result in poor performance.

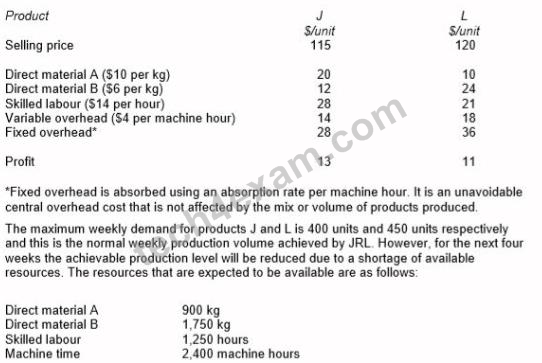

4. JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

Identify, using graphical linear programming, the weekly production schedule for products J and L that will maximize the profits of JRL during the next four weeks.

A) The solution from the graph is to produce 330 units of J and 280 units of L. (A simplex solution shows the true optimum to be 332.333 units of J and 283.333 units of L.)

B) The solution from the graph is to produce 330 units of J and 290 units of L. (A simplex solution shows the true optimum to be 332.333 units of J and 293.333 units of L.)

C) The solution from the graph is to produce 317 units of J and 270 units of L. (A simplex solution shows the true optimum to be 316.666 units of J and 269.666 units of L.)

D) The solution from the graph is to produce 312 units of J and 295 units of L. (A simplex solution shows the true optimum to be 312.333 units of J and 294.999 units of L.)

E) The solution from the graph is to produce 315 units of J and 290 units of L. (A simplex solution shows the true optimum to be 316.333 units of J and 293.333 units of L.)

F) The solution from the graph is to produce 310 units of J and 280 units of L. (A simplex solution shows the true optimum to be 308.333 units of J and 283.333 units of L.)

5. TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers' specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively.

TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

Prepare a statement which reconciles the flexed budget material cost and the actual material cost. Your statement should include the material price planning variances, and the operational variances including material price, material mix and material yield.

What was the material price planning variance for ingredient A?

A) The Material price planning variance - Ingredient A was $75 000 F

B) The Material price planning variance - Ingredient A was $72 000 F

C) The Material price planning variance - Ingredient A was $73 000 F

D) The Material price planning variance - Ingredient A was $71 000 F

質問と回答:

| 質問 # 1 正解: B | 質問 # 2 正解: A、C、D | 質問 # 3 正解: A、B、C、D、F | 質問 # 4 正解: F | 質問 # 5 正解: B |

弊社は製品に自信を持っており、面倒な製品を提供していません。

弊社は製品に自信を持っており、面倒な製品を提供していません。

Inamori

Inamori