返金するポリシーはありますか? 失敗した場合、どうすれば返金できますか?

はい。弊社はあなたが我々の練習問題を使用して試験に合格しないと全額返金を保証します。返金プロセスは非常に簡単です:購入日から60日以内に不合格成績書を弊社に送っていいです。弊社は成績書を確認した後で、返金を行います。お金は7日以内に支払い口座に戻ります。

CIMAPRO15-P01-X1-ENGテストエンジンはどのシステムに適用しますか?

オンラインテストエンジンは、WEBブラウザをベースとしたソフトウェアなので、Windows / Mac / Android / iOSなどをサポートできます。どんな電設備でも使用でき、自己ペースで練習できます。オンラインテストエンジンはオフラインの練習をサポートしていますが、前提条件は初めてインターネットで実行することです。

ソフトテストエンジンは、Java環境で運行するWindowsシステムに適用して、複数のコンピュータにインストールすることができます。

PDF版は、Adobe ReaderやFoxit Reader、Google Docsなどの読書ツールに読むことができます。

更新されたCIMAPRO15-P01-X1-ENG試験参考書を得ることができ、取得方法?

はい、購入後に1年間の無料アップデートを享受できます。更新があれば、私たちのシステムは更新されたCIMAPRO15-P01-X1-ENG試験参考書をあなたのメールボックスに自動的に送ります。

あなたのテストエンジンはどのように実行しますか?

あなたのPCにダウンロードしてインストールすると、CIMA CIMAPRO15-P01-X1-ENGテスト問題を練習し、'練習試験'と '仮想試験'2つの異なるオプションを使用してあなたの質問と回答を確認することができます。

仮想試験 - 時間制限付きに試験問題で自分自身をテストします。

練習試験 - 試験問題を1つ1つレビューし、正解をビューします。

割引はありますか?

我々社は顧客にいくつかの割引を提供します。 特恵には制限はありません。 弊社のサイトで定期的にチェックしてクーポンを入手することができます。

Tech4Examはどんな試験参考書を提供していますか?

テストエンジン:CIMAPRO15-P01-X1-ENG試験試験エンジンは、あなた自身のデバイスにダウンロードして運行できます。インタラクティブでシミュレートされた環境でテストを行います。

PDF(テストエンジンのコピー):内容はテストエンジンと同じで、印刷をサポートしています。

購入後、どれくらいCIMAPRO15-P01-X1-ENG試験参考書を入手できますか?

あなたは5-10分以内にCIMA CIMAPRO15-P01-X1-ENG試験参考書を付くメールを受信します。そして即時ダウンロードして勉強します。購入後にCIMAPRO15-P01-X1-ENG試験参考書を入手しないなら、すぐにメールでお問い合わせください。

あなたはCIMAPRO15-P01-X1-ENG試験参考書の更新をどのぐらいでリリースしていますか?

すべての試験参考書は常に更新されますが、固定日付には更新されません。弊社の専門チームは、試験のアップデートに十分の注意を払い、彼らは常にそれに応じてCIMAPRO15-P01-X1-ENG試験内容をアップグレードします。

CIMA P1 - Management Accounting Question Tutorial 認定 CIMAPRO15-P01-X1-ENG 試験問題:

1. Explain how probability analysis could be used to assess the risk of the evaluated projects.

Select all the true statements.

A) The probabilities can be combined to calculate the expected value of each cash flow element and of the project as a whole

B) The net present value (NPV) of the project, if all high, low or medium estimates occurred, can be calculated along with the combined probabilities of their occurrence.

C) The NPVs of a sample range of possible outcomes and the probability of each NPV can be calculated. If a small sample is taken the distribution of outcomes can be used to calculate the zero activities deviation of the NPVs and the probability of success of the projects.

D) The company can determine a range of possible outcomes for each of the cash flows in the project, for example, a high, low and medium estimate of each cash flow could be determined.

2. A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company's existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department's support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company's accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine, using the current basis for charging the costs of support activities to machines.

A) The profit per machine for the medium machine was: $1376

B) The profit per machine for the medium machine was: $1250

C) The profit per machine for the medium machine was: $1350

D) The profit per machine for the medium machine was: $1276

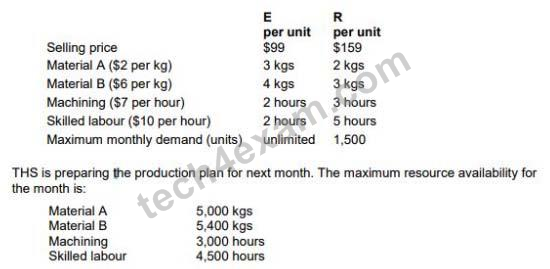

3. THS produces two products from different combinations of the same resources. Details of the products are shown below:

Identify, using graphical linear programming, the optimal production plan for products E and R to maximize THS's profit in the month.

A) The solution (from the graph0 is to produce 375 units of E and 870 units of R.

B) The solution (from the graph0 is to produce 675 units of E and 470 units of R.

C) The solution (from the graph0 is to produce 495 units of E and 670 units of R.

D) The solution (from the graph0 is to produce 495 units of E and 470 units of R.

E) The solution (from the graph0 is to produce 475 units of E and 770 units of R.

F) The solution (from the graph0 is to produce 375 units of E and 750 units of R.

4. A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company's existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department's support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company's accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.

A) Profit Per Machine using ABC: Small $196, Medium $1191, Large $1046

B) Profit Per Machine using ABC: Small $176, Medium $1341, Large $946

C) Profit Per Machine using ABC: Small $376, Medium $2341, Large $986

D) Profit Per Machine using ABC: Small $166, Medium $1241, Large $746

E) Profit Per Machine using ABC: Small $186, Medium $1441, Large $2046

F) Profit Per Machine using ABC: Small $1076, Medium $1041, Large $1946

5. JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

The optimal solution in the previous question shows that the shadow prices of skilled labour and direct material A are as follows:

Skilled labour $ Nil

Direct material A $11.70

Explain the relevance of these values to the management of JRL.

What is the additional contribution that can be earned?

A) Thus the additional contribution that can be earned and therefore the penalty value at which WRX would decide not to supply the major customer order in full is $5, 825

B) Thus the additional contribution that can be earned and therefore the penalty value at which WRX would decide not to supply the major customer order in full is $3, 825

C) Thus the additional contribution that can be earned and therefore the penalty value at which WRX would decide not to supply the major customer order in full is $4, 825

D) Thus the additional contribution that can be earned and therefore the penalty value at which WRX would decide not to supply the major customer order in full is $4, 570

質問と回答:

| 質問 # 1 正解: A、B、D | 質問 # 2 正解: D | 質問 # 3 正解: F | 質問 # 4 正解: D | 質問 # 5 正解: C |

弊社は製品に自信を持っており、面倒な製品を提供していません。

弊社は製品に自信を持っており、面倒な製品を提供していません。

-Watabe

-Watabe